Omni-Channel Compliance

Powerful Alone. Invincible Together.

Simplify Your Tech Stack With One Platform

Credit card providers know that a nimble and effective marketing compliance program focused on partnerships is critical for growth. PerformLine finds and mitigates marketing risk for compliant growth.

Omni-Channel Compliance

Simplify Your Tech Stack With One Platform

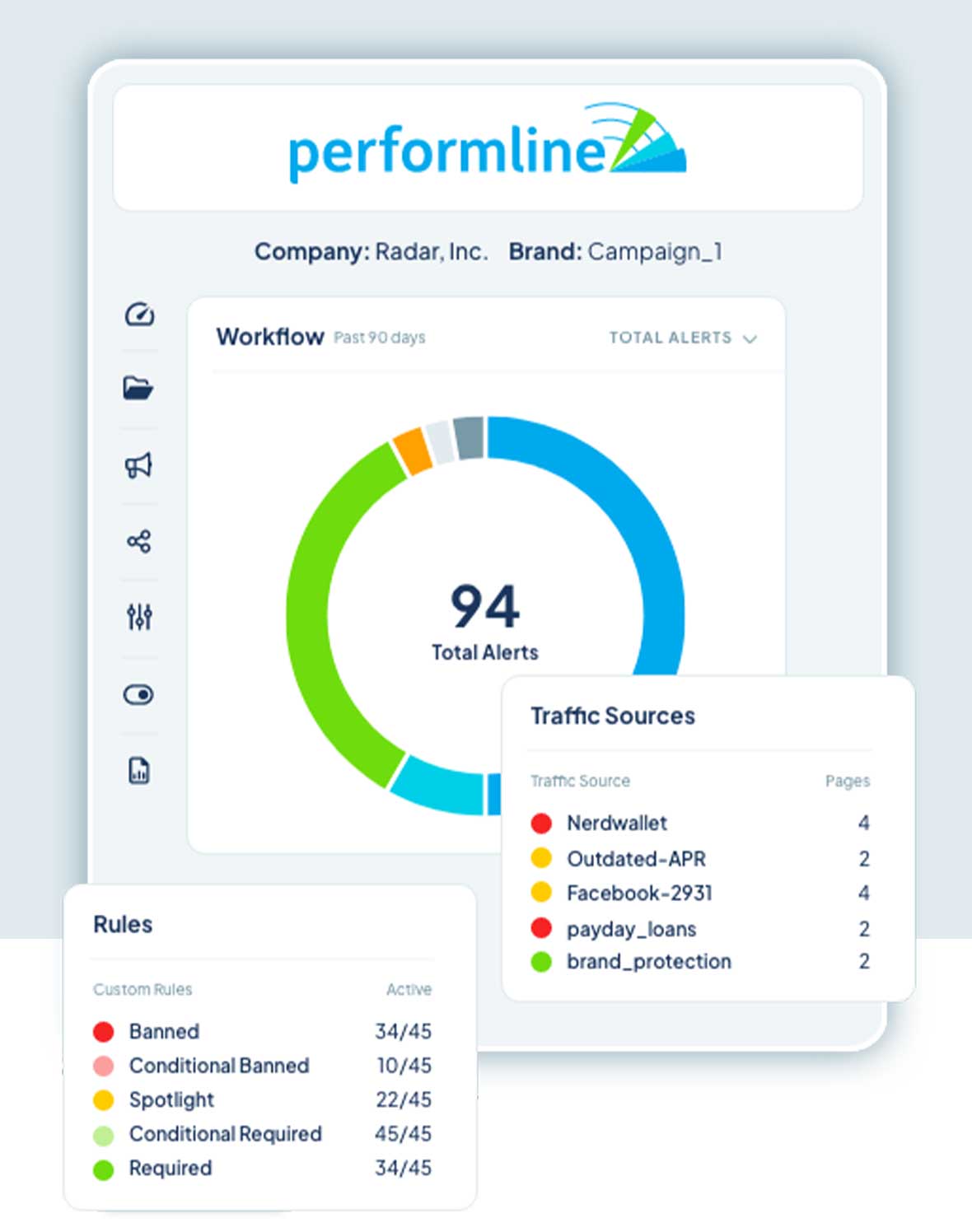

Find the web pages, emails, and social posts that mention your credit card listings across marketing partner sites for compliance against your terms/conditions and TILA requirements.

Demonstrate a commitment to marketing compliance and consumer protection with always-on discovery and monitoring.

Maximize time and cost savings by consolidating compliance efforts into one comprehensive platform to streamline processes for rate adjustments, disclosure updates, and offers enhancements; and extend this oversight of your third-party partnerships for enhanced cost and time savings.

Maximize time and cost savings by consolidating compliance efforts into one comprehensive platform.

Demonstrate to regulators that you’re taking the necessary steps to ensure compliance with a complete history of discovery through remediation for any audit situation.

PerformLine enables credit card compliance teams to identify and address compliance risk through our end-to-end solution, from marketing material review to remediation.

PerformLine replaces the need for multiple, disconnected solutions and provides a centralized, scalable omni-channel marketing compliance management process for credit card providers. Experience total efficiency with PerformLine’s all-in-one solution – One Platform, One Process, One Truth.

PerformLine’s partnership has allowed us to automate manual web monitoring efforts and provide scalability to increase coverage across thousands of web and social media sites. We are thrilled to be recognized and look forward to continued partnership with PerformLine.

Product Manager, Marketing Workflow & Tools

Bread Financial

How PerformLine helped a major credit card issuer increase their card offerings 8x

Additional Content

Credit card companies can monitor their affiliate partners for compliance using PerformLine’s omni-channel compliance platform to automate and scale marketing compliance reviews and monitoring.

Credit card companies should use PerformLine to monitor a variety of consumer marketing channels for compliance, including the web (including affiliate marketing sites), calls, emails, messages, and social media. Prior to publication, credit card companies should review and approve marketing collateral from partners and affiliates for compliance.

Using PerformLine’s marketing compliance technology, credit card companies should monitor for (but are not limited to) the Credit Card Accountability Responsibility and Disclosure (CARD) Act, Fair Credit Reporting Act (FCRA), the Truth in Lending Act (TILA), Unfair, Deceptive or Abusive Acts or Practices (UDAAP), state regulations, and other consumer protection laws.

Yes, PerformLine’s marketing compliance monitoring solution is adaptable to ever-changing regulations and industry guidelines, making it an ideal solution for credit card companies.

Yes, credit card companies can monitor APR rates across known and unknown partner sites using PerformLine’s Web Monitoring solution to ensure accuracy and marketing compliance.

PerformLine’s Business Intelligence provides detailed reporting and analytics for credit card companies, including industry benchmarking data, partner compliance performance, trends over time, workflow activity, and more.